New Debt To Income Ratio's Way Too Late

Doing it now will cement in place existing inequities that should never been allowed

The average house price in New Zealand, even having come back recently, is still around $930,495 as of Apr 2024, depending on the source.

The median house price versus median income, even having come back recently, still ranges from 6 to 10 times greater, depending on the region. It is widely recognised that anything above 3 times greater is inequitable and socially destabilising.

The average house price versus the Consumer Price Index measure of inflation has also parted company with house prices taking off into the stratosphere.

Theres already been a great deal of destabalising inequity allowed into the system.

On 28 May 2024 Kate Le Quesne The Director of Prudential Policy of the Reserve Bank of New Zealand(RBNZ) presented a video (In full at bottom) announcing Debt To Income Restriction Ratios on Home Lending (DTI) being implemented as 1 July 2024:

“Meant to make sure that banks don't take on too much risky lending during economic booms, which could result in a wave of defaults during an economic downturn.”

“Under the new DTI rules banks will be able to make a maximum of 20% of new owner-occupier lending to borrowers with a DTI ratio over six and 20% of new investor lending to borrowers with a DTI ratio over seven. This means you won't be impacted by the DTI rules if you borrow less than six times what your household earns before tax in a year as an owner occupier or seven times your income as an investor.”

“Let's take an example of a family looking to buy their first home.

This family has an annual pretax income of $120,000, with $20,000 of existing debt.

Since they intend to occupy the property, a DTI threshold of six will apply.

This means they could borrow up to $700,000 before they are considered high DTI.

This is six times their yearly income, minus that $20,000 of existing debt.The bank could, of course, decide to lend more or less than this figure.”

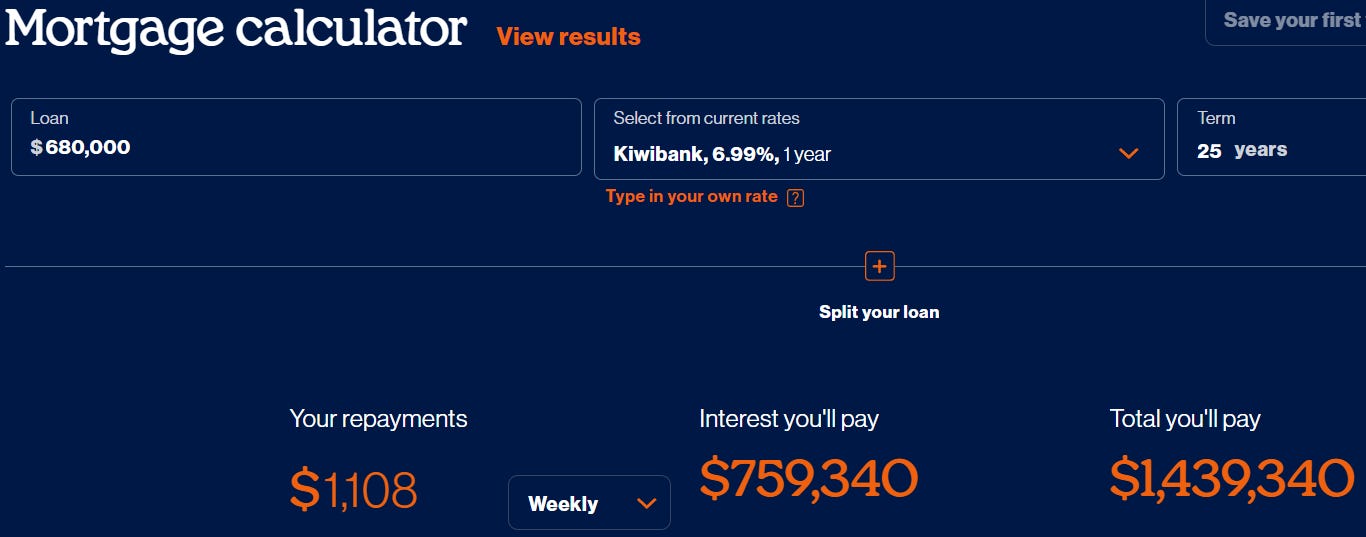

When you run the figures through a mortgage calculator with the lowest 1-year fixed interest rate available at present, it comes out as this:

As I mentioned most economists agree that when the median house price to average income ratio exceeds 3 times greater it causes societally destabalising wealth inequality.

Don Brash, the former New Zealand Reserve Bank Governor 1988 – 2002 , said in an August 2023 Sqawk Box interview (In the video at bottom) about an article he wrote saying:

"To be regarded as “affordable”, the median house price in an urban area should be no more than about three times the median household income in that area. In Auckland, the median house price is somewhere around 10 times the median household income. In Tauranga, the multiple is almost 12 times – and for houses which are often quite small, on miniscule sections. It is a shocking situation, and explains much of the social distress felt by a great many people – young families at one end of the age spectrum and the elderly who chanced not to have bought into the house price explosion when they were younger, and now face almost impossible rents.”

Now to help get where I am coming from about DTI cementing already existing inequality that should never of been allowed to happen in the first place, you first need to learn a few facts about the base money supply of New Zealand that our political system and the owners of our banking system keep as quiet about as the lack of wider public knowledge lets them.

Getting them to openly discuss it is like pulling hen’s teeth.

Like where the base money supply of New Zealand comes from presently and has done for most of its post-continuous European contact history.

This from the RBNZ Nov 2015 Financial Stability Report gives us a big heads up as to where the base money supply of New Zealand comes from:

https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/financial-stability-reports/fsr-nov2015.pdf

Box B Implications of Global Liquidity Developments for New Zealand

"There are three key channels through which New Zealand could be affected by declining market liquidity: the impact on New Zealand banks’ funding markets; the impact on short-term interest rates and monetary policy implementation; and the impact on the New Zealand government bond market”

“New Zealand banks fund a significant proportion of their balance sheets by accessing offshore wholesale debt markets. They do this by borrowing in foreign currency, then ‘swapping’ this back into NZD. Conditions in global financial markets are therefore an important determinant of New Zealand bank funding. New Zealand banks tend to focus on the primary market (new issues) rather than the secondary market for debt. Hence, funding liquidity is of more immediate importance than market liquidity. Funding liquidity refers to the ability of the banks to raise debt as required at a reasonable cost.”

“New Zealand banks typically use market makers to help facilitate the foreign currency swap leg involved in borrowing from offshore. Market makers take the other side of the transaction with New Zealand banks (providing NZD in exchange for foreign currency that the banks have raised), while charging a spread. This spread has widened as costs have increased for the institutions providing these market making services for the reasons described above. Overall, the cost increases have been manageable thus far, but this highlights the flow-on effects of changes in market liquidity to New Zealand entities seeking offshore funding."

end

From my over 20 years of research, without getting right down in the weeds I believe this structure is a relic from our colonial days in which colonies were forced to use the Empires currency as their currency delivered as loans of compound interest-bearing debt, that demonstrably favoured the Empire, or more accurately the Imperial elements in the homeland of the Empire that exploit their own subjects as much as those in the colonies.

Put simply the Reserve Bank of New Zealand is a state-owned shell company that provides the money supply to the New Zealand Government, domestic retail banks, and other financial institutions that have accounts with it, but the funds for the RBNZ come from the New Zealand Debt Management Office housed within the Treasury across the street from it on The Terrace in Wellington, over the intersection from Parliament, if our financial system needs more credit to increase our base money supply, especially in times of crisis, in what is referred to as Open Money Market Operations within the Money Transmission Mechanism.

The Funds are sourced by way of compounding interest-bearing loans from Investment Banks (Banks that are non-savings based but type credit into their computers creating the basis of new money, different to retail banks) external to our economy, which are referred to in the New Zealand system as Registered Counterparties, but elsewhere such as America as Primary Bond Dealers.

The current list of approved Registered Tender Counterparties are:

ANZ Bank New Zealand Limited

Bank of New Zealand

Citigroup Global Markets Limited

Commonwealth Bank of Australia

J.P. Morgan Securities Australia Limited

UBS AG, Australia

Westpac Banking Corporation, New Zealand.

The list used to be entirely foreign investment banks and the appearance of New Zealand subsidiaries of Australian Banks has been a more recent thing, which means there has been a reduction in the level our currency borrowed in foreign currency then swapped in and out that can be pointed to, but it makes very little difference to how much it remains a foreign liability.

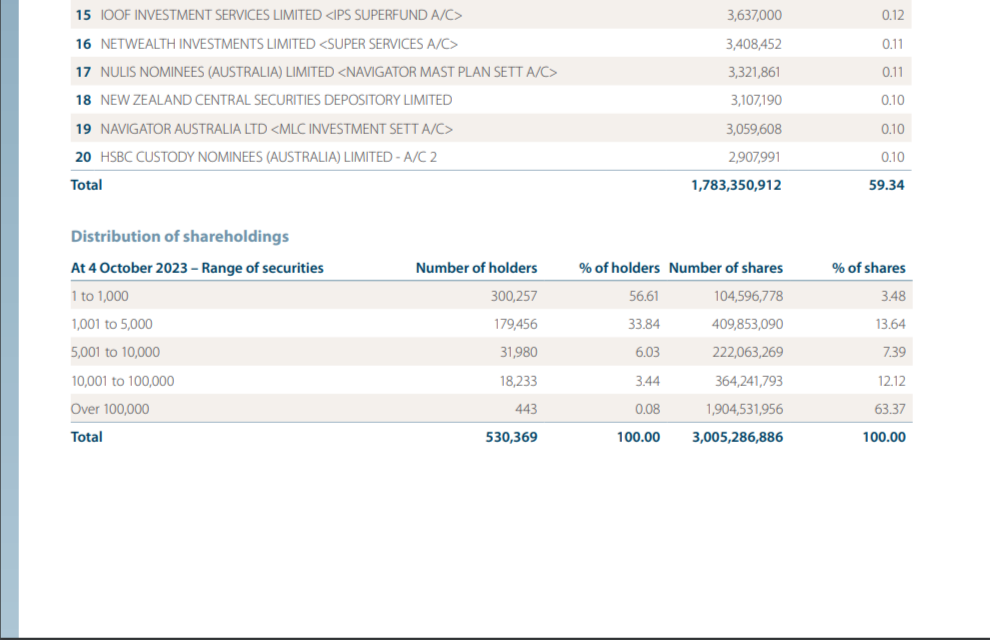

Because if you go to the Shareholder Information sections in the annual reports of all of the institutions in the list above, and all major corporations for that matter, you will find a list of Euro/American Investment banks, with an increasing presense of a massive private equity fund named Blackrock, that are the Primary Bond Dealers that fund the US Federal Reserve Bank the same way they ultimately do many other Reserve or Central Banks, including America, England, Canada, Australia, New Zealand.

For example this is from the ANZ 2023 Annual Report:

So we have ended up with the RBNZ/NZDMO Public Private Partnership sitting in between a bunch of domestic credit assessing agents on one side and a bunch of credit writing foreign investment banks on the other side, with a clear conflict of interest moral hazard that they would cook the books to exploit society by issuing it more credit than they knew was good for it in pursuit of profit.

We were told we dont need to keep a physical accounting eye on the quantity of credit the system was writing versus the forecast productive capacity to sustainably service it, which would first cause abnormal inflation of prices then a debt overhang bankruptcy, we only need to keep an eye on the price of a bunch of goods and services(The Consumer Price Index -CPI) to see if prices were abnormally increasing and if it did happen to increase the compounding interest rate attached to the debt money supply to reduce the amount of money in existence, reducing prices.

But some people on the CPI Review Committee in 1999 decided in their great wisdom to remove from the CPI measure of inflation the sale of existing houses, the price of land, and mortgage interest payments, which just happens to coinside with when house and land prices starting heading into the stratosphere at abnormal speed pumped full of foreign investment bank computer entry compounding interest loaned credit without setting the monetary policy adjustment alarm off when it should have because some people in their great wisdom had removed the bells from the alarm system.

The flaws of real estate not being accurately recorded in the CPI for monetary policy adjustment causing the exploitation of society by the private banking sector is now being addressed in many jurisdictions in the Transatlantic Imperial Banking Empire Orbit:

Owner-Occupied Housing Costs and Monetary Policy: Goals and Challenges for the Euro Area

https://www.europarl.europa.eu/cmsdata/241553/04_QA0721045ENN2.pdf

Here in New Zealand during the Five Yearly Monetary Policy Committee Review process the topic of if Real Estate is measured accurately enough in the CPI measure of inflation used for monetary policy adjustments, the private banking sector won the day over those that raised concerns, with basically been judged it should remain the same because the public now trust it:

Treasury Advice on the Reserve Bank's Proposed Scope of Remit Advice Information Release

https://www.treasury.govt.nz/sites/default/files/2022-10/rbnz-info-release-tr-1724_2.pdf

”The measure of prices and housing costs 34. One area of concern raised in public submissions was the role of housing costs and house prices in the measurement of inflation. One submission also raised concerns around the inflationary outcomes over time for working class communities. However, most public submissions generally supported retaining the Consumer Price Index (CPI) as the price measure targeted by the MPC. 35. While the current position of the RBNZ is that the CPI remains fit-for-purpose, given the public interest in this issue we believe there is value in including the definition, or measurement, of prices in the second consultation.8 This will include a discussion of alternative price measures and how housing costs are incorporated into the CPI in New Zealand.”

Here we sit today with the banks inside and outside of the New Zealand economy, owned by the same major shareholding few, with a clear conflict of interest, having made record profits pumping an abnormal land price bubble, with the powers that be now prescribing higher compounding interest rates as the solution as though its all our fault.

With Debt to Income Restriction Ratios now to be imposed at levels the borrower will still remain essentially a debt slave if they are able to get financing, but in truth the move has now essentially prevented them from ever being able to own their own home because the bubble prices remain above what they are now able to borrow.

Even if it were now to bring land prices back, what then of the foreign debt negative equity overhang that would then remain?

Only one thing for sure I allege, it is another win, win for the Imperialist Monopolists at the heart of the Transatlantic Privately Owned Banking Network System and lose, lose for wider society.

I have added some wise advice from economist Adair Turner in the video below. Do you think he and I are wrong?